Program

Toronto Impact Initiative

- Social Finance

Why we offer this

The Toronto Impact Initiative (TII) is working to build a future that includes entrepreneurs and businesses from communities that have been traditionally overlooked and ignored by mainstream finance.

By giving communities access to capital, both social and financial, it allows for more sustainable, inclusive and equitable communities for generations to come.

Are you a business or startup interested in receiving investments from this fund?

Please fill out this form and let's talk!

Join the Toronto Impact InitiativeHow it works

Background

It was the heightened awareness born out of the COVID crisis, but also Black Lives Matter, planetary climate warming, Truth and Reconciliation, the housing and homelessness crisis, that many became aware that standard financial instruments were not up to the task of confronting these issues with impactful solutions.

The Toronto Impact Initiative (TII) was developed in response to the growing demand for financial investment models that could be developed as alternatives to mainstream financial investment practices. Particularly, with an emphasis on investments in communities that have been denied, overlooked or ignored by standard commercial lending operators.

TII is a project at North York Community House.

What we Offer

A community and place-based social financing model that differs from mainstream investing (where an attractive rate of financial return is the sole motivation on investment). Instead, TII focuses the investment on the social, environmental, cultural and economic benefits of an initiative, on the organization’s work and on the health of the community and society as a whole.

Goal

The goal for TII is to serve primarily members of low-income, racialized, newcomer, and otherwise marginalized communities that traditionally face increased barriers to accessing finance. The focus is on facilitating a community-driven process that will inform the development of this investment fund.

The expectation is that the community will also play a central role in the governance and decision-making of this fund. Therefore, building and maintaining the right relationships with the community is a key part of the project.

How Social Finance can be Used

Examples:

YWCA Toronto

An association by, for and about women, girls and gender diverse people raised $1 million in community bonds to build affordable housing for rent. Their tenants included low-income women, women with mental health issues, and female-led Indigenous families.

The government rent supplements made the difference between resident payments and the market rate for rent.

The building income generated was used towards repaying this bond over 10 years.

Rhythm Rhythm

A social enterprise using hand drums to teach K-12 students about music and community building. They raised an investment from the Social Enterprise Fund to finance the purchase of instruments and to begin offering online teacher training.

They used workshops and training revenues towards repaying their investment.

Our Strategy

Our strategy is to design a community based social finance model that is relevant and responsive to the collective needs of the community through collaboration with its members.

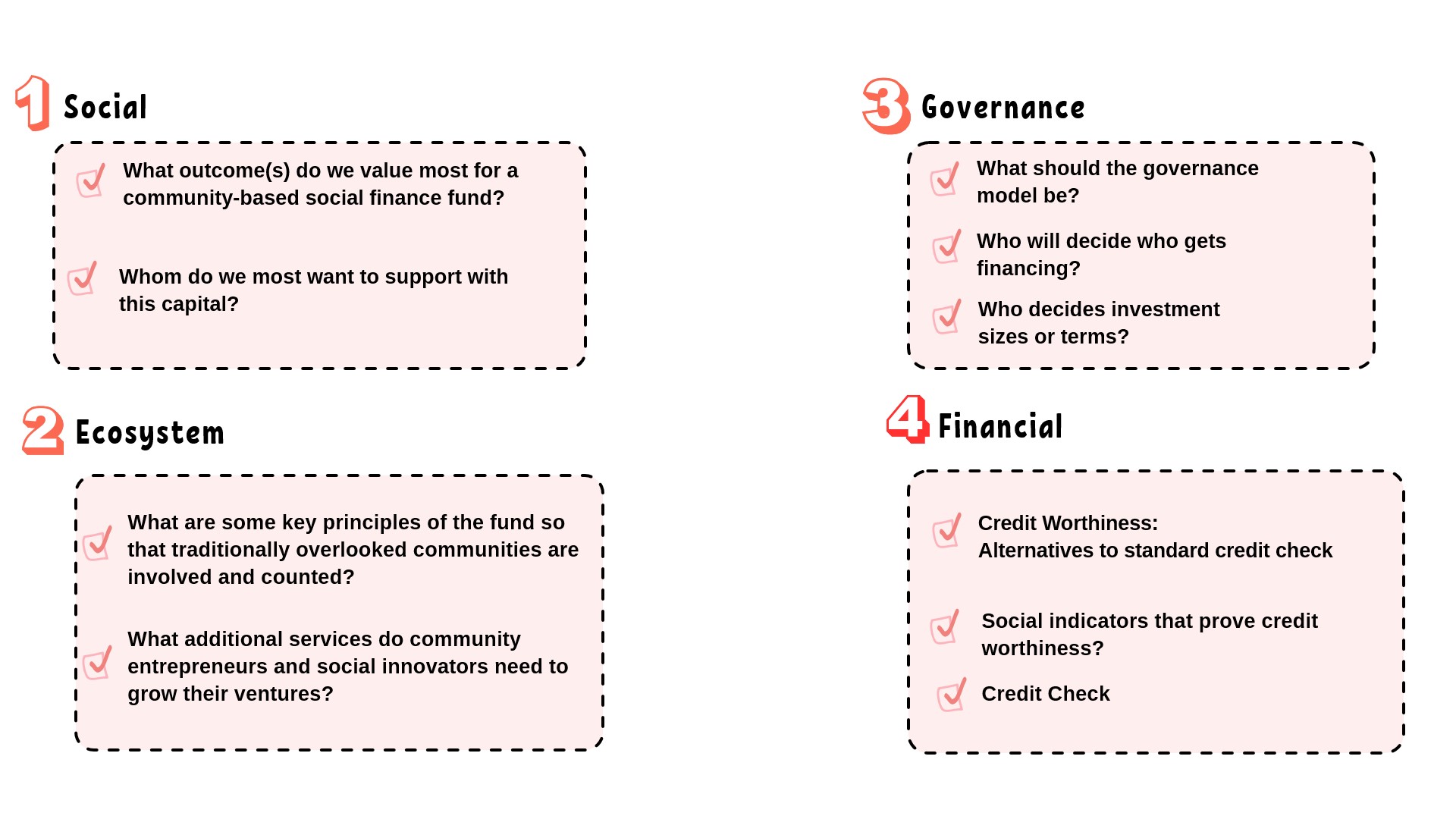

Through a co-design process in the form of virtual Community of Practices sessions, TII will be developed through discussion, analysis and feedback with community members and stakeholders.

Criteria of the TII Social Financing Model

For more information contact