Financial Literacy Month at North York Community House

“Every year for Financial Literacy Month, we do activities, workshops, and information sessions with quizzes and games.”

Every year, November is celebrated as Financial Literacy Month in Canada.

This presents an opportunity to learn more about money. At North York Community House (NYCH), Jyothi, Lead Staff of Financial Empowerment for Newcomers, and her team planned learning opportunities for residents and newcomers. She says the aim of her work is to help newcomers and residents take steps toward becoming financially independent.

“Every year for Financial Literacy Month, we do activities, workshops, and information sessions with quizzes and games.” — Jyothi

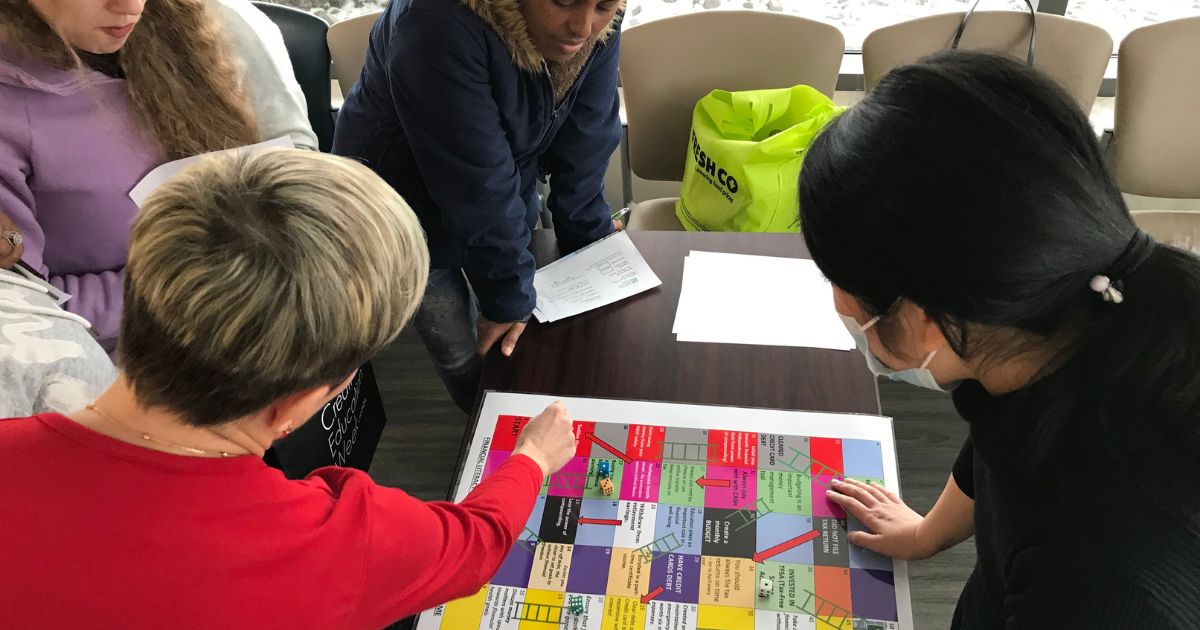

This year, on November 16th at NYCH, the Language Instruction for Newcomers to Canada (LINC) students learned about finances in Canada and left the event feeling empowered.

They played Financial Snakes and Ladders with Financial Empowerment Worker, Lu. In this re-imagined children’s game, the snake squares on the board game contained information such as, “You forgot to pay your credit card bill.” Since this has negative consequences on your finances, you slide down on the board. The ladder squares on the board contain phrases like, “You saved in your TSFA.” Since this has a positive financial impact, you move up the board.

“This is one way to talk about financial systems in Canada in a simple and accessible way,” Jyothi explains.

At the event, they also had Financial Literacy Worker, Ghazwan, set up at a desk answering any questions attendees had about an array of financial topics.

“One of the main challenges our clients face is a lack of authentic information,” Jyothi says.

She explains that many people make financial decisions based on advice from their friends and family that may not be accurate. This can lead to “adverse consequences”.

“We strive to provide reliable information with the help of Prosper Canada, who we work with closely.” — Jyothi

Prosper Canada is a pan-Canadian charitable organization that has many resources in the area of financial literacy. They provide these resources to community agencies like NYCH who pass on the information to community members.

This November, the Financial Literacy team also held four workshops at a Downsview Public Library and OCAD University. The workshop topics ranged from The Benefit Wayfinder Tool which helps community members access a list of which benefits they’re eligible for; budgeting; credit cards; credit scores; and the importance of maintaining a good credit history in Canada.

One challenge for newcomers to Canada is that someone can be financially literate in their home country but may not be in Canada.

“To give you an example, there are certain countries where there are no bank charges or account fees,” Jyothi says.

Sometimes newcomers associate the need to file taxes with their immigration status when they are not related — everyone with a valid status in Canada must file their taxes.

To address these needs, Jyothi and the team offer one-on-one financial coaching and support with tax filing year-round.

Jyothi speaks to the strengths of the community members she works with when it comes to finances.

“I find that most women especially are very good at budgeting. They might not have heard the term ‘budgeting’, but they plan and mentally try to balance their expenses and income.” — Jyothi

She says their knowledge of budgeting comes from life experience.

“They try to save as much as they can and make their dollar stretch. This is one of the greatest strengths they have.”

Another strength of the community members is their openness and receptiveness to the financial information NYCH provides.

She says that couples who have school-age children want to know how to save for their children’s college education. Newcomers want to know what a credit score is and how it will affect them.

“Asking these questions point in the right direction because then they’re more aware, and can make informed financial decisions. I would say all these are steps towards becoming more financially independent.” — Jyothi

Although November has been a busy month at NYCH for financial literacy, as an organization, we stride to provide newcomers and community residents with accurate, reliable financial information year-round.